LID BACKGROUND

A local improvement district (LID) is a funding tool governed by state law, by which property owners pay to help fund the costs of public improvements that directly benefit their property. The Waterfront LID improvements are a multi-year investment in Seattle’s central waterfront totaling approximately $739 million and are anticipated to be completed in 2024. Property owners within the Waterfront LID boundary area are contributing to a portion of the LID improvement costs based on the “special benefit” they receive from those improvements. The LID is a key component of the Waterfront Seattle Program funding plan, along with City and State funding and private philanthropy. An LID was included in the Waterfront Strategic Plan and approved by Council in 2012.

As part of the Waterfront Seattle funding plan, Seattle City Council passed Ordinance 125760 establishing a Local Improvement District (LID) on January 22, 2019.

On June 14, 2021, Council passed the Waterfront LID Assessment Roll Ordinance No. 126374 confirming the Final Assessment Roll for the Waterfront LID. The Final Assessment Roll is on file and available to be viewed at the Office of the City Clerk and online: final assessment roll.

2021 LID ASSESSMENT PREPAYMENT PROCESS

On July 9, 2021, consistent with state law, the City of Seattle Treasury Division of the Finance and Administrative Services Department (FAS) mailed a Prepayment Assessment Notice to each owner or reputed owner in the LID boundary area to the address shown on the tax rolls of the King County Treasurer (see sample Prepayment Assessment Notice). The Prepayment Assessment Notice provided the assessment amount due for each parcel and contained information regarding the option to prepay the assessment in full or in part during an initial 30-day prepayment-period without incurring interest. The one time 30-day Prepayment Period concluded on August 10, 2021 and is no longer a payment option available to owners in the LID boundary area.

LID ASSESSMENT PAYMENT PROCESS

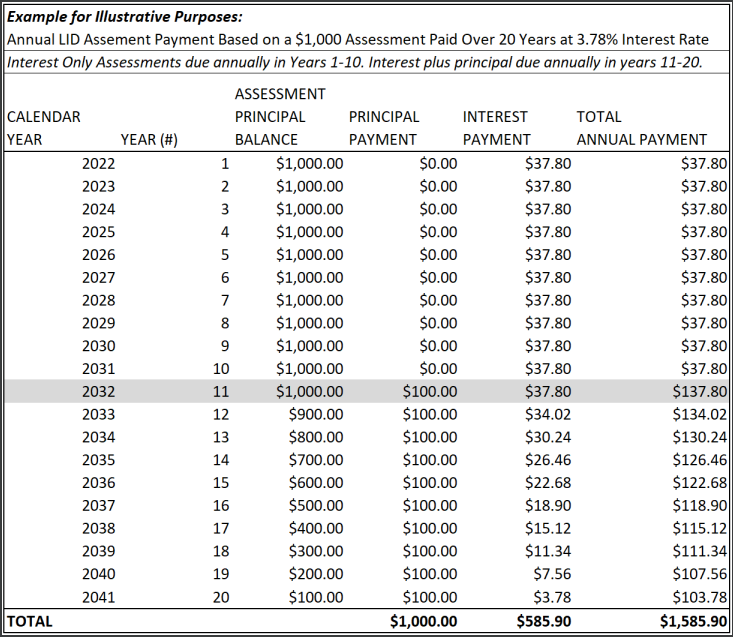

Beginning in 2022, and continuing through 2041 (the 20th anniversary of the end of the Prepayment Period), the City of Seattle Treasury Division of the Finance and Administrative Services Department (FAS) will send a LID assessment payment notice annually to each owner or reputed owner in the LID boundary area to the address shown on the tax rolls of the King County Treasurer. LID assessment billing will be due on August, 10, 2022 and continue annually for 20 years or until the assessment is deemed paid in full.

As described in the Waterfront LID Assessment Roll Ordinance No. 126374, for the first 10 years (2022-2031) annual installments will be billed as interest-only installments, meaning that only the interest on the principal balance of the assessment will be due in years 1-10. In years 11-20, installments will be billed as interest plus equal annual principal installments. This will result in a much larger assessment billing amount in year 11 compared to year 10 as illustrated in the table below. The outstanding principal balance of each LID Assessment bears interest at a rate of 3.78%.

There is no penalty for prepayment of all or any portion of the principal balance at any time. Please note interest is paid in arrears and is not prorated. Any payment made after the annual payment due date is subject to a full year’s interest. Property owners may prepay assessments in full or in part at any time so long as all principal and penalties, together with interest payable through the next annual installment payment date, are paid.

PURCHASE OR REFINANCE OF A PROPERTY IN THE LID BOUNDARY AREA

The assessment is a lien on the property and remains a lien on the property until it is paid in full (or foreclosed upon). The lien and its priority are described in RCW 35.50.010.

The City is unable to provide additional guidance regarding the LID in relation to finances. Property owners should seek advice from a financial advisor relating to refinancing or resubordinating a property in the LID.

CHANGES IN PROPERTY INFORMATION

The address and property information used for the Waterfront LID notifications is provided by the King County Treasurer’s Office. You can view property information on-file with the County online. If there are errors associated with the address or property information, or changes have occurred, please contact King County to correct this data. LID Assessment billing notices will continue to be sent to the address on-file with King County until it is corrected directly by the property owner with the County.

- To review or request to make updates to your King County property data directly, visit: http://blue.kingcounty.com/Assessor/eRealProperty/default.aspx. All requested changes are subject to approval by King County.

- To update your property information including mailing address and taxpayer name, contact King County Treasury Operations (kingcountytreasurer@kingcounty.gov; 206-263-2890; https://www.kingcounty.gov/depts/finance-business-operations/treasury.aspx) and provide the following information: Parcel ID, property address, mailing address, taxpayer name and tax account number.

All other property updates including changes to ownership or present use, contact the King County Department of Assessments (Assessor.Info@KingCounty.Gov; 206-296-7300; https://kingcounty.gov/depts/assessor.aspx3.)

DEFERRALS FOR ECONOMICALLY DISADVANTAGED PROPERTY OWNERS

The annual collection of assessments may be deferred for qualifying economically disadvantaged property owners under RCW 35.43.250 and 35.54.100 and SMC 20.12. Each request for a deferral of an annual installment payment must be submitted on or before such installment becomes delinquent. Please contact the City of Seattle LID Administrator at 206.233.7172 or email LID-Administrator@Seattle.gov.

Related Documents

- Waterfront Local Improvement District Ordinance January 2019 [webpage]

- Council Resolution November 2019 [webpage]

- Proposed LID Final Assessment Roll November 2019 [webpage] [PDF]

- Notification Letter Sample December 2019 [PDF]

- Final Special Benefit Study & Special Benefit Study Addenda December 2019 [2 PDF Documents]

- Hearing Procedural Rules for the Assessment Roll Hearing January 2020 [PDF]

- Assessment Roll Hearing Report September 2020

- Notice the Assessment Roll Hearing Report is on File September 2020 [PDF]

- Resolution remanding certain properties and rescheduling appeal hearings November 2020 [webpage]

- Final Assessment Roll Hearing Report February 2021 [webpage]

- Notice the Final Assessment Roll Hearing report is on file February 2021 [webpage]

- Prepayment Notification Letter Sample July 2021 [PDF]

- Waterfront Local Improvement District Bond Ordinance [PDF]

Contact us

If you have any questions related to LID assessments, or other LID matters, contact the City of Seattle LID Administrator at 206.233.7172 or email LID-Administrator@Seattle.gov.

Translation and interpretation services are available upon request by contacting the City at 206.684.2489

- Servicios de traducción e interpretación disponibles bajo petición – 206.684.2489

- 我们可以提供翻译服务 – 206.684.2489